Wind of Investments: Yuan instead of Euro?

14.10.2014

Probably, the main advantage of Russia for foreign investors is a large internal consumer market (although owing to a slower growth of demand it does not seem so substantial anymore), but this plus is, obviously, not the only one. For many years the most valuable factor for foreign business has been liberal exchange regulations that existed in Russia. Since the 2000s Russian financial authorities have conducted a rather liberal policy as regards exchange control, they cannot even dream of in China, India, Brazil or other developing countries, while all the restrictions for any capital transfers were removed as early as the beginning of the first decade of the century.

For foreign investors (both portfolio and direct ones) from Western countries freedom of exchange operations compensated for corruption at the local level, an unfree and undeveloped court system, since conditions were created for probable prompt take-out of capital.

However, the situation is changing nowadays. Foreign political events can cause changes in exchange regulations, and, consequently, make the market a little less attractive. Western and Russian economies turn away from each other, which causes capital outflow, while Russia turns its face towards the East that has gained economic power.

The question is whether Chinese investors will be able to take the niche which was intended for Western investments. On the one hand, Western business, even before introduction of sanctions, exhausted its resources, to some degree, while in China they have been dreading the reproduction of the scenario of a financial crisis caused by overinvesting in local real estate for a long time. Thus, investments in a neighboring state, i.e. Russia, can become an acceptable alternative.

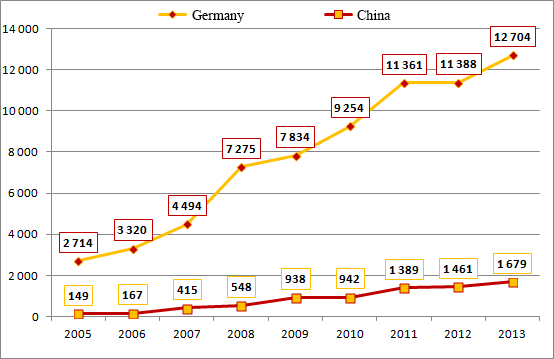

On the other hand, the volume of accumulated direct investments in Russia from Germany in the same year of 2013 exceeded direct investments from China 7.5 times. European countries have extensive experience of work in Russia. As for Chinese investors, an enormous number of countries are waiting for them, and Russia not always can take a competitive position. Moreover, Russia risks becoming a kind of transit for money of developing countries for further conversion into euros or dollars.

Schedule 1. Volume of accumulated direct foreign investments from China and Germany to Russian economy in 2005–2013, million dollars

Source: Federal Service of State Statistics

Nevertheless, Russian market can well expect the beginning of a new cycle in relationships with Western business, if the foreign political situation in the nearest months improves. The regions of Siberia and Far East, not spoilt with foreign money, can finally, after reorientation of Russian politics towards the Asian and Pacific region, receive full attention of the centre and with its help start working with their neighbors fruitfully. The economy is tired of bad news.