Dynamics of Investments in Standard Introduction Pilot Regions

17.10.2014

The Regional investment standard is a set of measures developed on the basis of the best investment practices used by more economically successful regions. The introduction of the Regional investment standard was commenced in 2012, when it was tried in 11 pilot regions (Bashkortostan, Tatarstan, Perm Krai, Sverdlovsk, Chelyabinsk, Ulyanovsk, Astrakhan, Belgorod, Tula, Kaluga and Yaroslavl regions). The experience of introduction was recognized as successful, so the standard became mandatory for all subjects of Russia.

The standard was developed in a way so that requirements it contained could be renewed with account for results of implementation. Its main purpose is translating best practices of increasing investment attractiveness of regions for improving investment climate and smoothing the irregularity that can be observed, in this regard, in different subjects of the Federation.

By the present time 83 regions have joined the program of Standard introduction, 47 of which have completed the introduction fully.

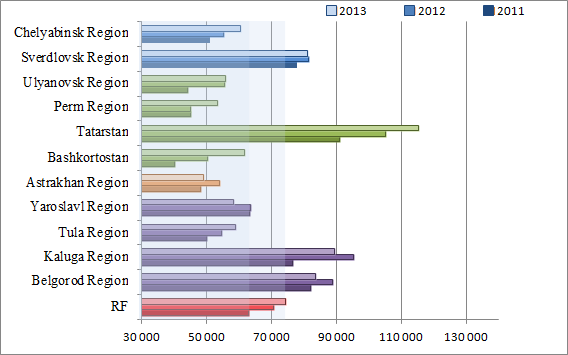

If we take the per capita rate of capital investment among pilot regions, the maximum value, which exceeded the level for the whole country by a third, was observed in 2011 in Tatarstan, the rate of Belgorod region exceeded the Russian level by 6%. Sverdlovsk region had the rate close to the country’s average level, while the per capita volume of capital investment in Kaluga region was a little lower (less than 1%). In other regions the volume of investment was significantly lower.

However, the situation is changing a little, if we exclude investment in production of fuel and energy resources, which have the greatest impact on rates of such regions as Tyumen and Sakhalin regions, from the average Russian rate.

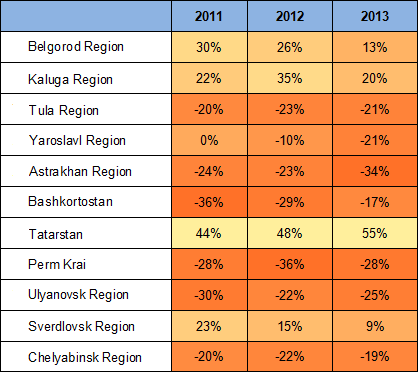

In this case the breakaway of Tatarstan was 44%, that of Belgorod region – 30%, that of Kaluga region – 22%, that of Sverdlovsk region – 23%, the rate of Yaroslavl region was close to the average Russian level. In order to provide more information that reflects attractiveness of regions for investments, the schedule shows the rate without investment in production of fossil fuels.

In 2012 Tatarstan was still the leader, having increased the gap to 48%. Kaluga Region exceeded the average Russian rate by 35%, Belgorod Region – by 26%. In Sverdlovsk Region the per capita volume of investment increased, though to a lesser degree than in the whole country; therefore, the gap was reduced to 15%. In other pilot regions the level of investment remained to be lower than the average country’s level by 10–35%.

In 2013 Tatarstan strengthened its leading positions, having exceeded the average rate by 55%. The gap for Kaluga Region decreased to 20%, that for Belgorod Region – by 13%. Sverdlovsk Region exceeded the average country’s rate by 9%. Other regions were still unable to achieve the average level. We shall note that per capita rates in 2013 decreased in Yaroslavl, Kaluga, Belgorod, Sverdlovsk and Astrakhan Regions.

Schedule 1. Dynamics of per capita investments (excl. investments in production of fossil fuels) in pilot regions in 2011–2013, rub.

Source: Federal Service of State Statistics

Source: Federal Service of State Statistics

Thus, there were both leaders and outsiders among the pilot regions. Tatarstan, Belgorod and Kaluga Regions were characterized with high, annually increasing volumes of investments, which, when calculated per capita, significantly exceeded the country’s rates. A reduction of the volume of investments in Kaluga and Belgorod Regions could be observed only in 2013, on the background of the general slowdown of investment activity. Belgorod, Yaroslavl, Astrakhan and Sverdlovsk Regions were able to improve their positions among other regions in the period of 2011-2013.

The annual growth of the per capita volume of investments since 2010 has been characteristic for almost all regions under consideration. In 2012 the rates of Kaluga and Ulyanovsk Regions, Bashkortostan increased by a quarter. In 2013 the rate of Perm Krai increased by 18%, while that of Chelyabinsk Region – by 9% (to compare, the average Russian rate increased by 5%).

Schedule 1. Gap between per capita rates of investments between Russia and its regions in 2011–2013, %

Source: Federal Service of State Statistics